Table Of Content

It’s easy to ACH payments and receipts via CashPro® ACH, CashPro® Connect and CashPro® API. You can create and deliver a standard ACH-formatted file using your business software, a payroll vendor or our ACH service. On the opposing end, if the entity is concerned about payments that may be inaccurate or “bounced” and unrealized until the product or service is delivered, ACH would not be the suggested option. Before you implement ACH payments into your business or opt-in for them in your personal life, make sure you have a complete picture of what they entail with their pros and cons.

Corporate credit or debit (CCD)

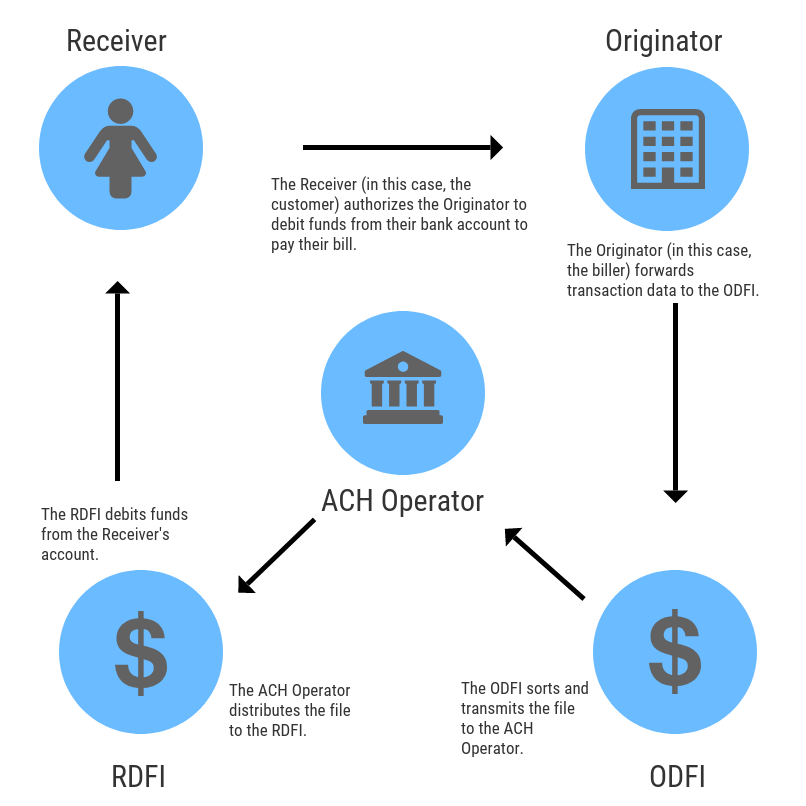

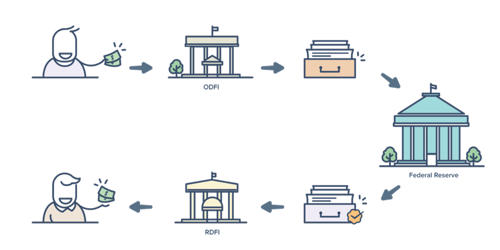

The clearing firm also ensures that all parties involved follow required procedures for a smoother transaction. CBP Automated Clearinghouse (ACH) is an electronic payment option that allows participants to pay customs fees, duties, and taxes electronically, as well as receive refunds of customs duties, taxes and fees electronically. The Federal Reserve or clearinghouse sorts through the batch and ensures the banks are authorized and can complete the transaction made by the intended recipient.

Nacha

The Clearing House Says Processing Error Impacted Less Than 1% of Daily ACH - PYMNTS.com

The Clearing House Says Processing Error Impacted Less Than 1% of Daily ACH.

Posted: Fri, 03 Nov 2023 07:00:00 GMT [source]

We’ll discuss the clearing house definition below, along with the situations when you’re likely to encounter one. Nacha develops the rules that enable Direct Deposits and ACH pay bill payments. And as a payments industry leader we do much more, including education, accreditation, and advisory services. Automated Clearing House (ACH) payments were first established in the 1970s by the Federal Reserve System and the banking industry. Up to that point, cash and checks had been the principal methods for retail payments in the United States.

The power to pay virtually

Automated clearing houses apply an electronic mechanism to this long-standing concept. The Federal Reserve Bank of San Francisco began operating the first ACH in 1972, after developing the system with a number of California banks. Additional ACHs were quickly formed in other cities, and in 1978 the Fed linked these ACHs together to communicate and process inter-regional transactions. The Fed consolidated its ACH operations into one standardized national network in the mid-1990s (Federal Reserve Bank of Dallas 1993a). For a transaction to occur, an entity must first make a direct deposit or payment using the ACH Network.

ACH transactions are a convenient way to get paid and make payments, whether you’re waking up to find a direct deposit in your checking account or avoiding the need to mail a paper check to the electric company. These transactions are a safe and relatively quick way of transferring money between banks. If you’re pressed for time, you may be better off finding an electronic payment option that runs on the Real-Time Payment (RTP) network. Launched in 2017 and run by The Clearing House, the RTP network allows consumers and businesses to send payments in real-time on a 24/7 basis. Currently, 65 percent of bank accounts in the U.S. are connected to this network, according to The Clearing House. While ACH is convenient, it’s not a perfect system for sending and receiving money.

The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. An ACH credit means money is being “pushed” from one account to another. The payer in an ACH credit transaction authorizes their bank to move money from their account to someone else’s. Transactions on the ACH network are categorized as either ACH credit or ACH debit transfers, depending on which way the money moves.

ACH payments, which are initiated electronically, were envisioned as a more-efficient payment method. Implementing an ACH system can be a prudent payment method option to cut the hassle and boost the use of automated bank transfers, as long as you are not looking for a same-day processing option. These transactions are digital, occurring when the consumer authorizes a transfer of funds with their online account or mobile device. A PPD is a single-entry, recurring ACH credit or recurring ACH debit. These transactions happen between an originator and a consumer to make or collect an authorized payment. NACHA rules ensure that banks can process payments the same day they’re sent, but it’s up to each bank whether it charges you for expediting a payment.

ACH Transfers: What They Are, How They Work and How Much They Cost - NerdWallet

ACH Transfers: What They Are, How They Work and How Much They Cost.

Posted: Mon, 06 Nov 2023 08:00:00 GMT [source]

Prior to initiating electronic credits or debits in the U.S., our Account Validation service can help you validate whether a bank account is open and if it belongs to the person authorizing payment to or from the account. The service can also help you to comply with the Nacha WEB Debit Account Validation rule that went into effect on March 19, 2021. With this new rule, ACH Originators of WEB debit entries are required to use a “commercially reasonable fraudulent transaction detection system” to screen WEB debits for fraud. The supplemental requirements apply to the first use of an account number, or changes to the account number.

With CitiDirect-ACH, users can set customized ACH Debit Filters and notifications to monitor and control ACH Debit transactions more effectively. In addition, advanced capabilities enable users to adjust system settings and controls in real-time to address evolving organizational needs. GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices. Find out how GoCardless can help you with ad hoc payments or recurring payments.

If an amount is credited to your account in error, then the individual or business that initiated the transfer may seek to have the money returned. In that scenario, the amount credited would be debited from your account. The Clearing House’s ACH payments service, called the Electronic Payments Network, is responsible for approximately half of all U.S. commercial ACH payment volume. The U.S. Federal Reserve banks handle the other half of ACH transactions. Federal Reserve or the Clearing House Payments Company, a private business owned by 24 of the world’s largest commercial banks. Savings accounts are governed by Federal Reserve Regulation D, which may limit certain types of withdrawals/transfers to six per month.

You may be limited in how much you can transfer, and you may incur fees. An Automated Clearing House or ACH transaction is an electronic transaction that requires a debit from an originating bank and a credit to a receiving bank. Transactions go through a clearinghouse that batches and sends them to the recipient's bank.

With an international wire transfer, for instance, it may take several business days for the money to move from one account to another, then another few days for the transfer to clear. You can also use an ACH transfer to make single or recurring deposits into an individual retirement account (IRA), a taxable brokerage account, or a college savings account. Business owners can use an ACH transfer to pay vendors or receive payments from clients and customers. YP - The Real Yellow PagesSM - helps you find the right local businesses to meet your specific needs. Search results are sorted by a combination of factors to give you a set of choices in response to your search criteria. “Preferred” listings, or those with featured website buttons, indicate YP advertisers who directly provide information about their businesses to help consumers make more informed buying decisions.

Businesses have their share of expenses, particularly paying suppliers. When they skip the checks and pay online, that’s a Business-to-Business payment, or B2B. One of the few certainties in the payments industry is that it’s always changing, so the pros need to stay at the top of their game. Nacha helps them do that with unparalleled educational opportunities that work with your schedule. Whether you attend in-person events and take advantage of great networking, or go virtual and learn on demand, Nacha has the education you need, on your terms.

For consumers, ACH payments offer a simpler process for paying bills. You can log in to your bank’s website, enter your biller’s details and schedule payments in minutes directly from your bank account. If you want to simplify things even further, you can schedule recurring ACH payments for your monthly bills. The ACH network is open for payment processing for more than 23 hours every business day, with payments settling four times a day. ACH payments can be credited the same day, the next day or within two days for speedy processing.

Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.Here is a list of our banking partners.

No comments:

Post a Comment